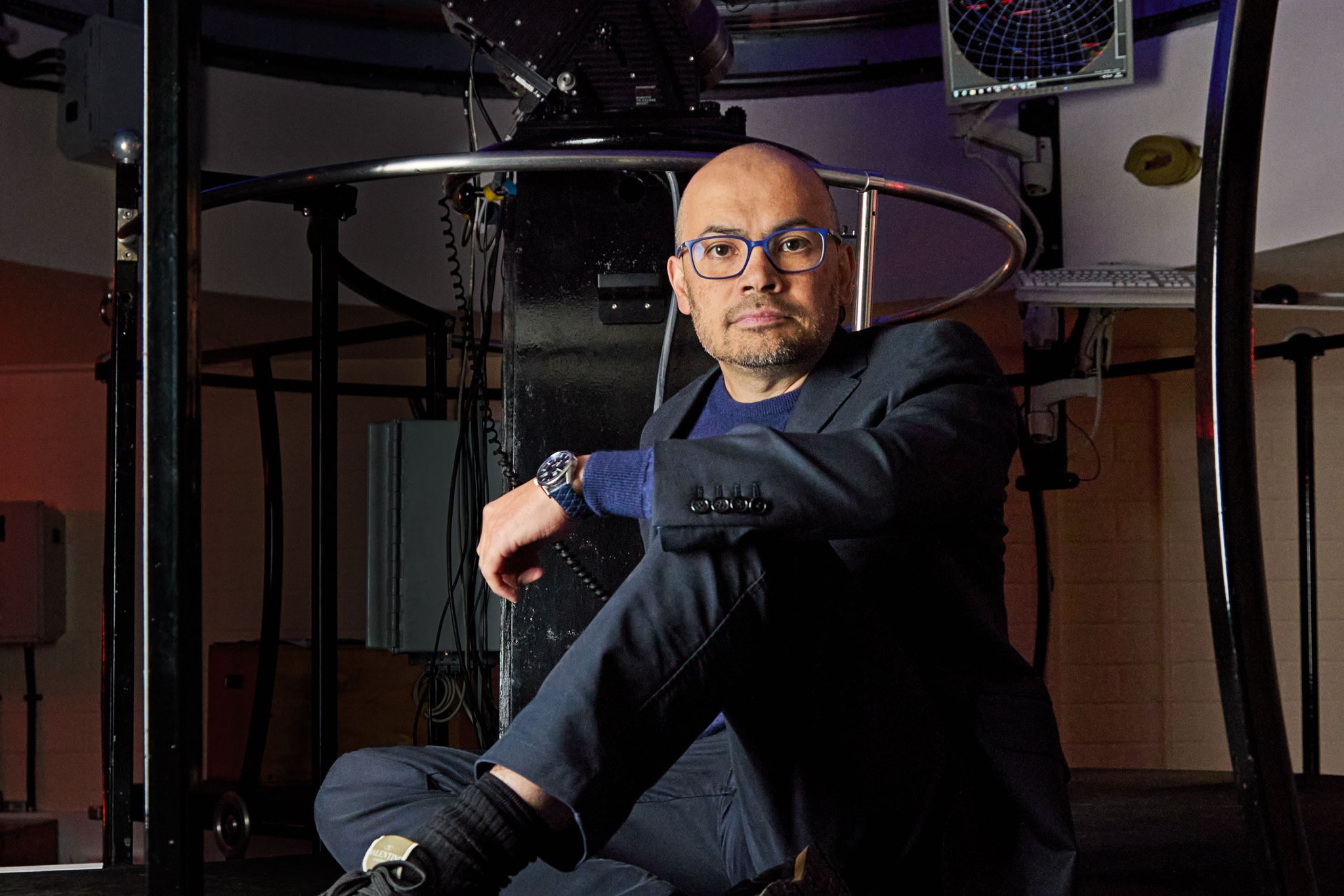

It was a brisk October night as Demis Hassabis and I talked about the stars.

There was good reason. For one, place: We were sitting in a London observatory opened in 1929. For another, metaphor: Talking about stars and constellations is a great way to talk about vastness, the wonders and limitations of what the human brain can process.

There’s vastness far closer to us that transcends even the stars. It may seem impossible but there are, in fact, more possible chemical compounds in our world than stars across the sky. And it’s not close: A conservative estimate suggests the number of small, drug-like molecules out there is somewhere around 10^60, while the number of stars in the observable universe lingers around 10^22 (perhaps 10^24 by some estimates).

I’ve been fixating on this for months, because it conveys the absolute impossibility of drug discovery. I always knew penicillin, for example, was an accident. But I didn’t realize every drug was effectively a miracle, a spectacular defiance of the scientific odds.

This week, Fortune published a magazine feature I’ve been thinking about since fall, an inside look at Hassabis’s Isomorphic Labs. Hassabis, Google DeepMind pioneer and Nobel Laureate, started Isomorphic in 2021 to turn the powers of AI on the vastness of chemical space and ultimately “solve all disease.”

It’s worth being clear about what that tagline actually means (and I certainly showed up in London prepared to give Hassabis a hard time about it). As I wrote:

When I bring this up to Hassabis, he outlines his philosophy: The idea of “solving disease” is broader and more practical than eliminating illness once and for all. There’s a reason that he doesn’t say “cure.” While you can’t promise no one will ever get sick again, he says, you can develop a systematic, repeatable, and scalable process—powered by advanced AI and technology platforms—for discovering, designing, and optimizing drugs or treatments as needs arise.

So, it’s not a tagline so much as a theory, mission, and in some sense a promise of what technology can make possible. Because a drug isn’t just a drug. It’s perhaps better treatment for something intractable, perhaps it’s a cure. And it’s most definitely more time for us or someone we love. Isomorphic doesn’t yet have a drug in clinical trials (and will say very little about exactly when that will happen). But make no mistake: Ultimately, the only success is a life-changing drug that reaches patients.

“To show the value of something like this, you have to really show it,” Google Ventures managing partner Krishna Yeshwant, a doctor-turned-investor who was involved in early conversations around Isomorphic, told me as I was reporting. “You have to discover your own drugs. You have to bring it through to people, and prove that it works.”

Isomorphic, like the entire AI drug discovery space, is entering a new era—one that demands results. If those results materialize, they’ll bring more than just better treatments for autoimmune disorders or cancer.

In the coming years, if Hassabis is right, an entirely new system will emerge. One that promises to, within reason, wrangle the vastness inside all of us.

Read the whole story here.

See you Monday,

Allie Garfinkle

X: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter. Subscribe here.

VENTURE CAPITAL

– Mews, an Amsterdam, The Netherlands-based operating system designed for hospitality, raised $300 million in Series D funding. EQT Growth led the round and was joined by Atomico, HarbourVest Partners, Kinnevik, Battery Ventures, and Tiger Global.

– Inferact, the San Francisco-based developer of the vLLM open-source interference engine, raised $150 million. a16z and Lightspeed led the round and was joined by Sequoia, Altimeter, Redpoint, and others.

– Preply, a Brookline, Mass.-based marketplace of language learning tutors, raised $150 million in Series D funding. WestCap led the round.

– LiveKit, a San Francisco-based platform designed for building voice, video, and physical AI agents, raised $100 million in Series C funding. Index Ventures led the round and was joined by Salesforce Ventures, Altimeter Capital, Redpoint Ventures, and Hanabi Capital.

– Railway, a San Francisco-based cloud infrastructure company, raised $100 million in Series B funding. TQ Ventures led the round and FPV Ventures, Redpoint, and Unusual Ventures.

– Cambio, a New York City-based operations platform designed for real estate investors, raised $18 million in Series A funding. Maverick Ventures led the round and was joined by Y Combinator, Adverb Ventures, Peterson Ventures, and others.

– Level3AI, a Singapore-based developer of AI assistants designed for enterprise customer service, raised $13 million in seed funding. Lightspeed led the round and was joined by BEENEXT, 500 Global, Sovereign’s Capital, and Goodwater Capital.

– Artie, a San Francisco-based data streaming platform, raised $12 million in Series A funding. Dalton Caldwell at Standard Capital led the round and was joined by Y Combinator, Pathlight Ventures, and angel investors.

– Nexxa.ai, a Sunnyvale, Calif.-based developer of AI agents designed for heavy industries, raised $9 million in seed funding. Construct Capital led the round and was joined by a16z speedrun.

PRIVATE EQUITY

– EQT agreed to acquire Coller Capital, a London, U.K.-based secondaries firm, for up to $3.7 billion.

– BlueRidge Life Sciences, backed by Renovus Capital Partners, acquired Design Science, a Philadelphia, Penn.-based life sciences consulting and services firm. Financial terms were not disclosed.

– PestCo Holdings, a portfolio company of Thompson Street Capital Partners, acquired Long Pest Control, a Tacoma, Wash.-based pest control company. Financial terms were not disclosed.

– Warner Pacific, backed by Lovell Minnick Partners, acquired Brokers Holding Group, a Columbia, S.C.-based financial services firm. Financial terms were not disclosed.

EXITS

– Aurora Capital Partners acquired Anova, a New Providence, N.J.-based developer of remote monitoring technology for fuel and gas manufacturers and distributors, from FFL Partners. Financial terms were not disclosed.

– Lone Star Funds agreed to acquire Alliance Ground International, a Miami, Fla.-based aviation handling company, from Greenbriar Equity Group and Audax Private Equity. Financial terms were not disclosed.

– Metagenics, backed by Gryphon Investors, acquired Symprove, a Farnham, U.K.-based probiotic brand, from bd-capital. Financial terms were not disclosed.

IPOS

– BitGo, Sioux Falls, S.D.-based cryptocurrency infrastructure company, plans to raise up to $200.6 million in an offering of 11.8 million shares priced between $15 and $17. Redpoint Associates, Valor Equity Partners, Craft Ventures, and Bridgescale Partners back the company.

FUNDS + FUNDS OF FUNDS

– Healthier Capital, a Menlo Park, Calif.-based venture capital firm, raised $220 million for its first fund focused on tech-enabled health care companies.

– Heartland Ventures, a Columbus, Ohio-based venture capital firm, raised $60 million for its third fund focused on manufacturing, construction, logistics, and real estate companies.

PEOPLE

– Base10, a San Francisco-based venture capital firm, promoted Dani London and Jacob Suh to principal.

Marketsprivate equity,Term Sheet,Venture Capital#Demis #Hassabis #wrangle #molecular #universe1769178865